Lies, Damn Lies, And Accounting

A perfect example of this doctrine at work can help to shed light on the current U.S. financial crisis. It involves a little-understood and badly under-reported accounting rule that was put in place in the wake of the Enron Corporation scandal of 2001. Enron, the Houston, Texas, energy giant collapsed like a house of cards when it was revealed that the company had used a questionable accounting scheme to grossly inflate the asset value of its holdings. The collapse left Enron's huge workforce unemployed, numerous members of its senior management charged with felonies, and countless stockholders bereft of their life's savings. The scandal also brought down the venerable Arthur Anderson accounting firm, which was deamed complicit in the scandal by failing to live up to its audit responsibility of protecting stockholders and the public from the devastating financial fiasco.

In the wake of Enron, the Federal Securities and Exchange Commission sought to make the asset value of securities more transparent to stockholders by tightening “Mark-to-Market” accounting standards so that balance sheet assets reflect their current market rather than the price at which these assets were purchased. Clearly the SEC's motive was well-intentioned.

However, in the opinion of numerous economists, the adjustment of these rules is directly related to the current crisis that sent Secretary of the Treasury Henry Paulson with his hat in hand to the Congress in search of what the media and others have dubbed as a Wall Sreet “bailout," designed to remedy the financial chaos that began when real estate markets faltered, followed by failures and/or mergers of major lending institutions. Faced with “restating” the balance sheet value of their mortgage-backed securities at the close of the 3rd fiscal quarter on September 30, firms holding significant shares of these “toxic” securities, saw their ability to borrow money dry up overnight because their asset value was now considered unknown. With the Stock Market in free fall and sources of credit becoming non-existent, the entire economy was said by Paulson, as well as an impressive variety of economic personages, was on the verge of collapse.

Is it possible that such a well-intentioned, yet little-understood, accounting rule alone could be responsible for as much as 70% of the grotesque financial crisis that had delivered the U.S. financial system to such a state of calamity? That's what a host of well-respected free-market economists believe.

Here’s an example of how the Mark-to-Market rules could throw a business into chaos. Suppose that you borrow money to purchase a sizable inventory of products at a set price, and you plan to sell these products at a profit over the next few years. But what if your ability to sell them is governed by an accounting rule that says that if you have one bad sale, you must then mark down the price of the rest of your inventory to match that bad sale . . . say two or three times below what you paid for it. Obviously you would have a liquidity problem, especially if your lender decided to call in your loan. Your products might still be sold at a profitable markup, but your are helpless to do so because of you must “mark” it to the “market” value of your most recent sale rather than keep it at it's purchased value because you plan to hold it until such time as the current downturn is over.

If not the entire reason for the September 2008 meltdown, the arguments posed that the Mark-to-Market rule is at least the proximate cause are fairly persuasive. They suggest that the chairman of the SEC could act to ease the rule so that a $700 billion rescue bill would not be needed . . . or at least not at that high a level of bailout. If you want to read more about the argument behind this point of view, click here and click here.

To learn more about an opposing point of view that argues for keeping the Mark-to-Marketing rule in place, click here.

My concern about the current "rescue" bill that is being cobbled together by Congress is that in its haste to solve this financial crisis, the Doctrine of Unintended Consequences will rear its ugly head at an undetermined future hour. Who knows what type of crisis it might precipitate.

In the meantime, I hope that photographers might take a moment to reflect about what accounting means in their businesses. I find that most photographers will do almost anything to avoid looking at and understanding their numbers.

If we learn anything from the current US fiscal crisis I hope it is this: Numbers have meaning that can illuminate or obscure what you need to know about your financial position. I love the statement that was popularized by Mark Twain: "There are three kinds of lies: lies, damned lies, and statistics." The statement refers to the persuasive power of numbers, the use of statistics to bolster weak arguments, and the tendency of people to reject statistics that do not support their positions. The same can be said for accounting. Because the numbers that constitute business accounting can be arranged in different ways, they, too, can be manipulated or rearranged to achieve a desired result.

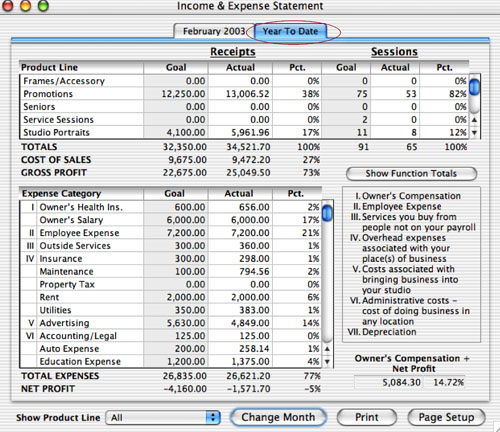

Most of financial reports that photographers receive from their accountants are Income/Expense statements generated for the purpose of tax filings, and they are virtually useless for formulating meaningful business strategies. However, the same numbers can be rearranged into a "Managerial" report (see SuccessWare I/E report computer screen below) that will allow you to understand your financial position on a daily basis, while providing additional information that will help you to manage your business with precision. More and more photographers are mastering this common-sense form of accounting that is far easier to understand than tax accounting. Ultimately this knowledge is the first step toward creating a better lifestyle for photographers. So I'm hopeful that the current economic crisis will have the happy unintended consequence of making photographers more interested in not only what went wrong with the U.S. banking system, but also what's going on with their businesses.

Want To Live Debt Free? See Frank & Tony Donnino.

Frank Donnino Tony Donnino

Several years ago Florida photographer Frank Donnino began telling me about a talk show radio program featuring Dave Ramsey, whose teachings he has been following in an effort to become totally debt free, both personally and professionally. I visited the Ramsey website and was impressed by the common sense strategies he espouses. Soon Frank was informally helping family members, friends, and other photographers get rid of debt that was causing stress or hampering their lifestyles.

Recently Frank informed me that he was officially debt free and that he and his son, Tony, had applied to become certified as official Ramsey debt councilors. Well, the Doninnos made the cut, and in November they will be Certified by the Ramsey organization so they can received referrals from Dave Ramsey directly.

Presently they are helping people by word of mouth, and I am impressed with his goals and how he has structured the service: Frank explains: "We will assist people in taking control of their out of control debt by using Dave Ramsey's teachings about becoming debt free. Through consultations by phone and via email, we can help people who are not only worried . . . but scared to death. A thirty-minute free consult starts the process, and we will not charge anyone unless they wish to take our recommendations and then we will continue to help them."

Most business experts agree that excessive debt, especially in times of economic slowdown, is the number-one business killer. So I'm glad that photographers will now have a place to turn for help, because I'm see far too many photographers whose businesses are crippled because of debt. If you want to learn more about the Donnino's service, log on to Don't Fret About Debt.com.

The Silly Season is Upon Us!

Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies.

-- Groucho Marx

At the risk of sounding like a seasoned cynic, I agree with Groucho . . . at least part of the time. I know there are many very dedicated public servants who want to do the right thing for the people who elect them, but given the seemingly unlimited resources of ever-competing special-interest groups, it's quite a challenge for any politician to break party ranks in search of "the right thing." So the political sausage machine grinds on, and for the small business person, the sausage options are not very tasty during an election year, when party rancor drowns out the common sense voices of the hardworking business people looking for a fair shake. Even though we represent much of the engine that fuels the American economy, our voice is hard to hear above the rancor of mindless politics. But that's no excuse for not doing the best we can with what we are offered on election day. At the very least, make sure you know where the candidates stand . . . if you can make any sense out of what passes for political reporting during a presidential election year.

People cast their votes for a host of intelligent and often hopeful reasons. But if you are concerned about the future of small business, then, in my opinion, you should look at the candidates' positions on the following:

- Tax rates: Does the candidate pledge not to raise them for short-term gain?

- Health care: Does the candidate support "association health-care programs?" PPA estimates that 70% of those without health insurance will be able to buy policies if trade associations were allowed to form the same group plans that are available to unions and government workers.

- The death tax: Urge candidates to do away with it, or we'll continue to lose family farms and other small businesses.

- The Alternative Minimum Tax: Do away with it IMMEDIATELY! This tax has to rank near the top of Incredible Congressional Blunders. Enacted by a cranky Congress in 1969, it was passed specifically to punish a mere 155 high-income households that were eligible for so many tax benefits that they owed little or no income tax under the Federal Tax Code. But because it was not indexed for inflation, this onerous tax could now include families that earn as little as $100,000. To keep Americans from hosting a modern-day Boston Tea Party, Congress has in recent years passed one-year patches aimed at minimizing the impact of the tax. For 2007, a patch was passed in December, but only after the IRS had already designed its forms for 2007. The redesign and computer reprogram will create potential delays for 2007 refunds. Brilliant! But worst of all, the government continues to gobble up the proceeds of this undeserved tax windfall. Give it a few more years, and Congress will be so addicted to the AMT that it will have little will or even fewer options for redirecting this taxation nightmare. Beware . . . it is creeping up on YOU!

- The FICA cap: Keep it where it is. Every time it moves up, business takes a hit.

- Social Security reform: In spite of the fact that it is the untouchable third rail of American politics, look for leaders who are determined to fix Social Security through unpopular measures such as raising the retirement age and/or reducing benefits. Otherwise, government will look to US to pay the bill.

Enter the "Software Police" -- Serious Business!

Every small business owner--including photographers--should read the FoxNews.com story entitled "Software 'Police' Accused of Targeting Small Business." The item sheds light on the Business Software Alliance (BSA), the powerful copyright-enforcement agency that supports such software giants as Microsoft and Adobe . . . companies whose software photographers use daily. So it's vital for you to understand the power this organization wields: The article maintains that almost 90% of the $13 million in judgments BSA won against software violators last year came from small businesses.

Yes, I know how irksome it is to deal with software licensing policies that are insanely confusing and inherently frustrating: Last week I found myself unable to use my laptop version of Microsoft Office while I was on the road doing a seminar because I had added another computer to my home network. I was tired of running up and downstairs all day, so I now have iMacs on both floors that ONLY I USE. But what really was troublesome about the episode was the fact that I had already bought and paid for another license for the MS Office products because I knew I needed one for the "third seat," and I had the info required to get the activation code for my laptop with me when I hit the road. But I found myself unable to gain access to the code because I have a new email address, I couldn't find a way to update my record, and the helpful folks on the MS Help Line were "unavailable at this time." So I had to borrow a computer in order to get by until I got home and had time to hunt down a Bill Gates employee. Grrrr . . .

In spite of such aggravations, it would be much worse to have the Business Software Alliance file a legal complaint that could bankrupt your studio. So please . . . do the right thing and pay for the software you use. They are watching us, and this is serious business. The fellow in the Fox News article concluded that that best thing to do is find other companies to deal with that aren't members of the Alliance. That's pretty silly and shortsighted from my perspective. The best thing, I believe, is not to violate copyrights in the first place. Isn't that what we ask our clients to do?

Write to your Congressman NOW!

Professional Photographers of America (PPA) urges all members, photographers and small business owners to ask their Congressional Representatives to support The Equity for Our Nation’s Self-Employed Act (H.R. 3660), co-sponsored by Congressman Ron Kind (D-WI 3rd) and Congressman Wally Herger (R-CA 2nd).

Self-employed individuals, including self-employed photographers, pay for health insurance costs with after-payroll tax dollars. This means that the money they use to buy health insurance for themselves and their families is subject to an additional 15.3 percent tax that no other employers or employees must pay.

All business entities other than sole-proprietors receive a deduction for health insurance premiums as an ordinary and necessary business expense for all employees, including owners. Employees and the owner pay for their health insurance premiums pre-tax; therefore, they are not subject to FICA taxes. However, sole-proprietors (Schedule C filers) do not receive this benefit. Their premiums are not paid with pre-tax dollars and are exposed to self-employment tax. Again, sole proprietors are the only business entity that does not receive a full deduction of health care costs.

Health insurance premiums average almost $12,000 per year for family coverage. It is estimated that HR 3660 will save every self-employed individual about $1700 annually.

PPA's Copyright and Government Affairs Office has made it very easy for you (even if you are not a PPA member) to contact your Congressman. Simply click here, then enter your ZIP Code in the first field. A sample email is there for your use, or you can write your own. It takes only a minute or two to accomplish this important task. Please do so NOW! This so important!

If you want to say thanks to PPA staff for the important work they are doing in our behalf, click here to drop a line to Al Hopper, Director of Membership.

Make More Money! Learn How in Memphis.

There's no better learning opportunity for studio owners and managers than the Make More Money Conference scheduled for July 29-August 1 at the fabulous Peabody Hotel in Memphis, TN, my favorite city for mouthwatering spareribs.

I'm doing a program on financial management, including pricing. I plan to be on the front row for most of the programs, as last year I learned more at the MMM Conference than at any event I attended. This year workflow has been added, so that makes the content even better!

You'll also be able to visit with BellaGrafica at the trade show, as well as meet with three of the company's team members: Beverly and Tim Walden and Sarah Petty, who are doing a joint program entitled "The Boutique Studio Experience." Don't miss it! To learn more about the conference content, click here.

Exciting News Today!

So I was thrilled to learn that the article was honored with a Gold award from the Southeast Magazine Association's annual awards. Here's what the judge had to say: “Compelling, focused, specific, impeccably researched and relevant to its audience: Those are the qualities that garnered Professional Photographer's “How You Can Make More Money” the Gold Award for Best Service Journalism. The story summarized industry benchmarks without becoming mired in extraneous detail, outlined specific recommendations for increasing profits and included real-life "turnaround" stories that illustrated how business owners could use the article’s tips to do exactly what the headline

promised. Bravo!"

Congratulations to Leslie Hunt, PPA CFO Scott Kurkian, and the staff of PPA’s Studio Management Services for their hard work. It’s not often that you get a pat on the back for an article about financial management in a photography magazine. It feels really good! If you haven’t read it yet, then click on the graphic below to download a pdf.

PPA's Benchmark Survey